The Allure of the Stock Market

The stock market has always fascinated people across the world. It is often described as the ultimate arena where fortunes are made, sometimes in minutes, and where dreams of financial freedom take shape.

For many beginners, entering this world feels overwhelming. Charts, terms, volatility, and stories of losses can be intimidating. Yet, millions continue to enter the market every year because it remains one of the most powerful ways to create wealth and achieve financial independence. In countries like India, the United States, and the United Kingdom, the rise of online trading platforms and demat accounts has made it possible for even first-time investors to start trading with just a smartphone. The promise of turning small savings into significant growth is what draws beginners to learn how to invest in the stock market.

Understanding the Stock Market Before You Trade

To begin the journey, it is essential to understand what the stock market truly represents. At its core, the market is a place where buyers and sellers come together to exchange shares of publicly listed companies. Each share represents a fraction of ownership in a company. If the company grows and performs well, the value of that share rises, rewarding the investor. If the company falters, the value declines.

In India, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) are the two key exchanges, while globally, giants like the New York Stock Exchange (NYSE) and NASDAQ dominate. These exchanges are the stage on which the drama of finance plays out daily.

Beginners often confuse trading with investing, yet the difference is important to grasp. Investing is about the long-term vision, buying quality stocks and holding them for years to allow compounding to create wealth. Trading is about short-term opportunities, entering and exiting positions within days or even minutes, aiming to benefit from price movements. Both paths have value, but they require very different mindsets and strategies.

Defining Your Purpose in the Market

No one should enter the financial markets without asking themselves why they are here. Some people wish to build long-term wealth through patient investments in blue-chip companies. Others are attracted by the thrill of daily trading, seeking to capture profits from price fluctuations. Many look for passive income through dividends, while some wish to grow savings faster than traditional instruments like fixed deposits.

Clarity of purpose is essential. A person who seeks long-term stability will need the patience of an investor, while someone who desires quick profits must be willing to accept the risks of active trading. Understanding your objective allows you to choose whether to focus on long-term stock market investing or short-term trading strategies.

Learning the Language of the Market

Every profession has its own vocabulary, and the stock market is no different. Words like equity, portfolio, volatility, IPO, market order, and limit order are not jargon meant to confuse, but essential terms that guide decisions. A demat account becomes the digital locker where shares are stored, while a trading account through a broker becomes the gateway to the exchanges.

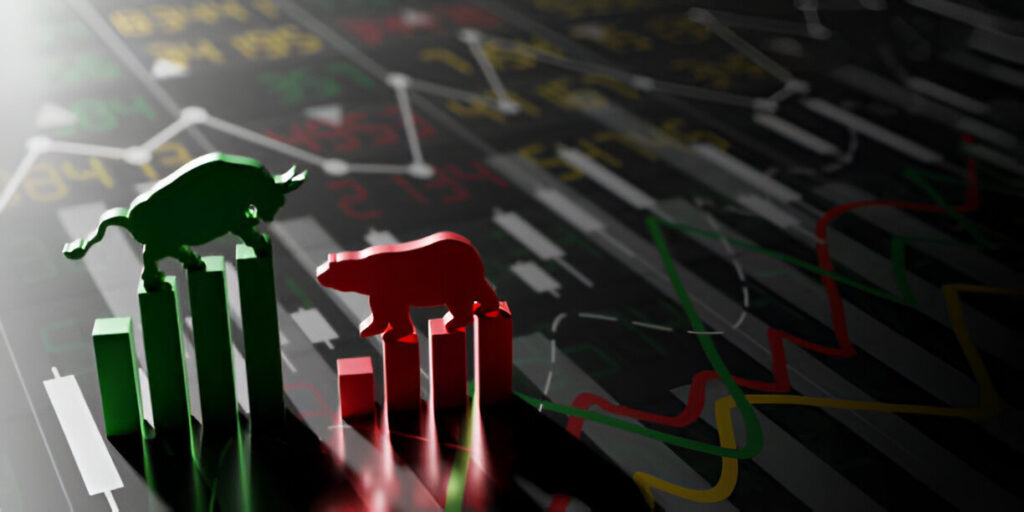

Knowing the meaning of a bull market and a bear market is crucial, as these terms describe phases of rising or falling prices. Similarly, recognizing the role of an Initial Public Offering (IPO) can open opportunities to invest in companies at the very beginning of their journey. Without learning these basics, a beginner may find themselves lost. The language of the market is the foundation upon which confidence is built.

Choosing a Broker and Opening Your First Demat Account

A beginner cannot trade directly on stock exchanges. This requires the help of a broker, who acts as the bridge between the trader and the market. In India, investors can choose between full-service brokers who provide research and advisory services, and discount brokers who offer low-cost, technology-driven platforms. The rise of apps like Zerodha Kite, Upstox, Groww, and Angel One has made trading more accessible than ever before.

Opening a demat and trading account is often the very first step for beginners. With digital KYC, Aadhaar, and PAN card verification, the process has become smooth and paperless. Once the account is activated and linked to a bank, the gateway to trading is unlocked. For someone stepping in for the first time, that moment of placing the first order becomes a memory they never forget.

The Power of Fundamental Analysis

Stock market trading is not gambling when done with knowledge. One of the most respected methods of evaluating a stock is fundamental analysis. This involves studying a company’s financial health, its growth prospects, its industry position, and its management quality.

A beginner who wishes to invest in companies like Infosys, Reliance, or Tata Motors must understand their balance sheets, revenue growth, profit margins, and debt levels. Looking at the price-to-earnings ratio tells whether the stock is valued fairly compared to its peers. Studying the industry trends ensures you are not investing in a declining sector. For those who seek long-term wealth, fundamental analysis is the compass that points toward strong, stable companies that can stand the test of time.

The Art of Technical Analysis

For traders who focus on shorter timeframes, technical analysis is the guiding light. Instead of financial statements, they study charts, price movements, and trading volumes. Each candle on a candlestick chart tells a story — whether buyers are in control or sellers are dominating. Indicators like the Relative Strength Index (RSI) reveal when a stock is overbought or oversold, while moving averages smooth out trends to show direction.

A trader watching the chart of Infosys or Tesla can often predict short-term movements before any news makes headlines. Technical analysis requires practice, patience, and an ability to read patterns. It is not about fortune-telling but about understanding probabilities. For beginners, learning technical analysis can open the doors to day trading and swing trading strategies, where profits are made by capturing smaller movements in price.

Different Paths of Trading and Investing

The stock market is not a single road but a network of paths. Some choose the life of day traders, entering and exiting positions within a single session. Others prefer swing trading, holding for days or weeks to ride a trend. There are those who focus on positional trading, keeping stocks for months, while investors like Warren Buffett dedicate their lives to long-term investing.

Each path has its own rhythm. Day trading requires quick decisions and constant attention. Swing trading allows for research and planning. Long-term investing rewards patience and conviction. A beginner must choose the path that suits their temperament. Someone who cannot tolerate constant stress may find peace in long-term investing, while someone who thrives on action may be drawn to intraday trading. The beauty of the market is that it accommodates every personality.

Managing Risk: The Invisible Shield of Success

If there is one lesson that every successful trader repeats, it is that risk management is more important than profit chasing. The market is full of stories of people who doubled their money quickly but lost it all because they ignored discipline.

The essence of risk management lies in never investing money that you cannot afford to lose. It means protecting your capital with stop-loss levels, diversifying across industries, and maintaining discipline even when emotions run high. A wise trader treats risk like an umbrella — you may not always need it, but when the storm comes, it saves you from ruin.

Technology and the Rise of Online Trading

The digital age has transformed the way stock market trading is done. No longer do investors need to call brokers on landlines. Today, a smartphone with apps like Zerodha or Robinhood can execute trades within seconds. Beginners benefit from real-time data, advanced charting tools, instant portfolio tracking, and access to global markets at the tap of a finger.

Technology has democratized the market. A student in Lucknow, a professional in Bengaluru, or a retiree in London can all participate equally. This revolution has made online stock trading one of the most exciting developments of the last decade.

The Psychology of Stock Market Trading

Markets are moved not only by earnings and indicators but also by human psychology. Fear and greed dominate the behavior of traders. Fear causes people to sell too early, missing out on gains. Greed tempts them to hold on too long, eroding profits. Successful traders learn to master their emotions, following strategies instead of impulses.

Trading psychology is about patience, discipline, and emotional control. A calm mind often makes better decisions than a restless one. For beginners, learning to keep emotions in check can be as important as learning to read charts.

Taxation and Regulations in Stock Trading

Trading is not just about making money; it is also about managing obligations. In India, the Securities and Exchange Board of India (SEBI) ensures fair practices. Profits are taxed based on how long you hold a stock. Gains from short-term trades are taxed at fifteen percent, while long-term gains beyond one lakh rupees attract ten percent tax. In other countries, taxation rules differ, but the principle remains: every trader must understand the legal framework that governs their profits.

Avoiding the Mistakes Most Beginners Make

The market is full of traps for the inexperienced. Many beginners lose money by following tips without research, by putting all their savings into a single stock, or by trading emotionally after a loss. Overconfidence after a few wins and desperation after a few losses are common patterns that destroy portfolios. The antidote to these mistakes is discipline, patience, and continuous learning. The stock market is a lifelong teacher, and humility is the price of admission.

Building Your First Portfolio

When a beginner is ready to invest, the question arises: what should the first portfolio look like? A wise approach is to balance stability and growth. Established blue-chip companies offer security, while mid-cap and sectoral leaders offer potential for faster growth. For those unsure about stock picking, exchange-traded funds and mutual funds provide exposure to multiple companies with professional management. Over time, the portfolio becomes a mirror of the investor’s journey — a story of risks, rewards, lessons, and growth.

The Difference Between Trading for Profits and Investing for Wealth

Short-term trading can deliver quick gains but also exposes the trader to volatility. Long-term investing, on the other hand, rewards patience and compound growth. Legendary investors like Warren Buffett emphasize that the stock market is a device for transferring money from the impatient to the patient. For beginners, the choice between trading and investing depends on temperament, goals, and discipline. Both paths can lead to success if pursued wisely.

The First Step Into the World of Trading

Starting in the stock market is not about perfection; it is about beginning. Opening the first account, placing the first order, making the first profit or loss — these are milestones in a journey that lasts a lifetime. The stock market is not a casino but a classroom, teaching lessons in patience, analysis, and resilience.

The beginner who steps in today with the right knowledge, discipline, and mindset can one day become a master trader or investor. The journey may be filled with challenges, but it is also filled with opportunities. The financial markets reward those who respect them, who study them, and who walk in with clarity rather than greed.

Your Path to Financial Freedom

The journey of stock market trading for beginners is about more than just making money. It is about learning how businesses grow, how economies move, and how human emotions shape markets. By understanding the basics of fundamental analysis, practicing the art of technical analysis, mastering trading psychology, and managing risk wisely, anyone can take control of their financial destiny.

The market does not promise riches overnight, but it promises lessons every day. Those who persevere, who invest time in learning, and who approach trading with discipline, can use the stock market as a powerful tool for building wealth and achieving freedom.